Governance

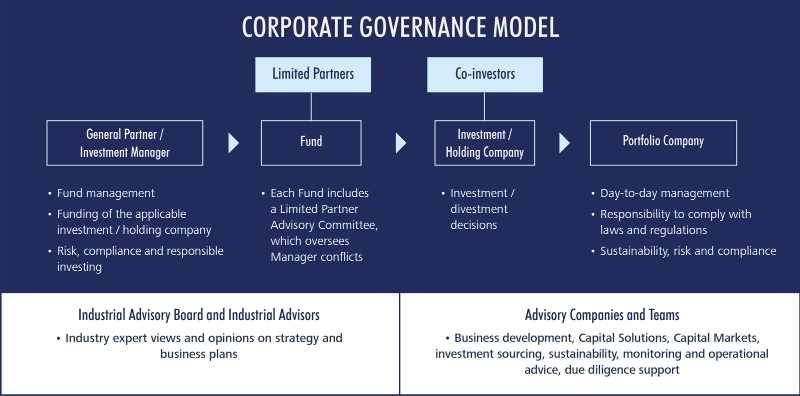

Investindustrial multi-layered approach to governance aims at a stringent segregation and allocation of roles and responsibilities among advisory teams, general partners and investment managers of the funds, investment and holding companies and, ultimately, management of each portfolio company.

The general partners and investment managers manage each of the funds in the interest of the respective limited partners and therefore in an autonomous and independent manner from other funds and group companies. The investment manager of the funds is an entity regulated and supervised by the Financial Conduct Authority in the United Kingdom and by the CSSF in Luxembourg pursuant to the EU Alternative Investment Fund Manager Directive and have arrangements in place to manage conflicts of interest, risk, compliance and responsible investing.

Investments and divestments are made (and shares in portfolio companies are held) by the applicable investment or holding company of each fund.

Decisions over investments and divestments, including the exercise of the voting rights over the shares of the portfolio companies, are made by the applicable investment or holding company board of directors in an autonomous and independent manner, consistent with the applicable corporate governance rules and by-laws.

It is the responsibility of the management of each portfolio company to operate the company on a day-to-day basis and implement rigorous compliance system and procedure.

Investindustrial expects that portfolio companies apply a rigorous and conservative approach to Corporate Governance based on clear roles and with full accountability.

Corporate Governance Model