26

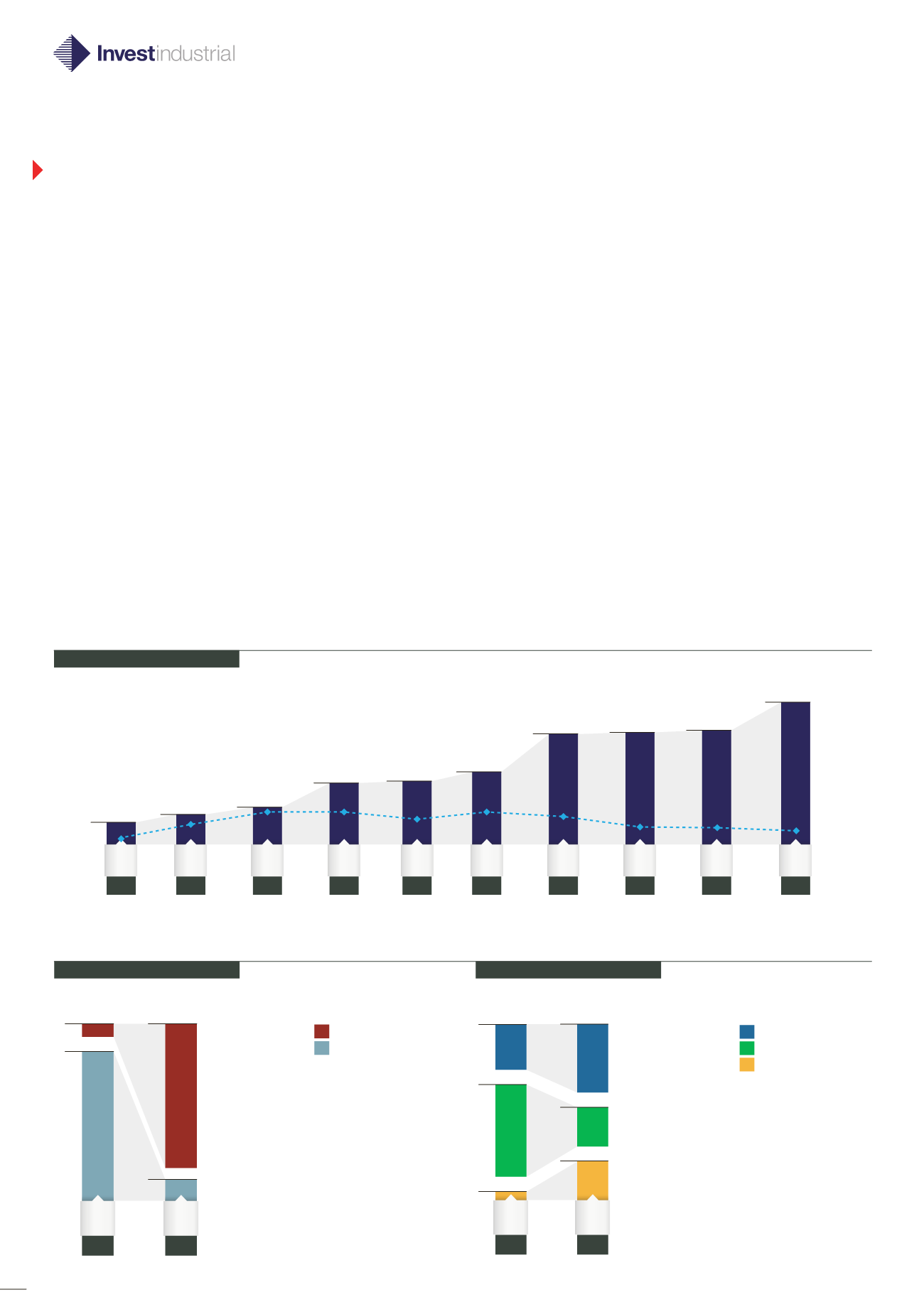

2014PF

2005

92%

8%

75%

25%

Rest of the World

Spain

2014PF

2005

5%

64%

31%

45%

25%

30%

Life and Rescue

Safety and Environment

Energy Support

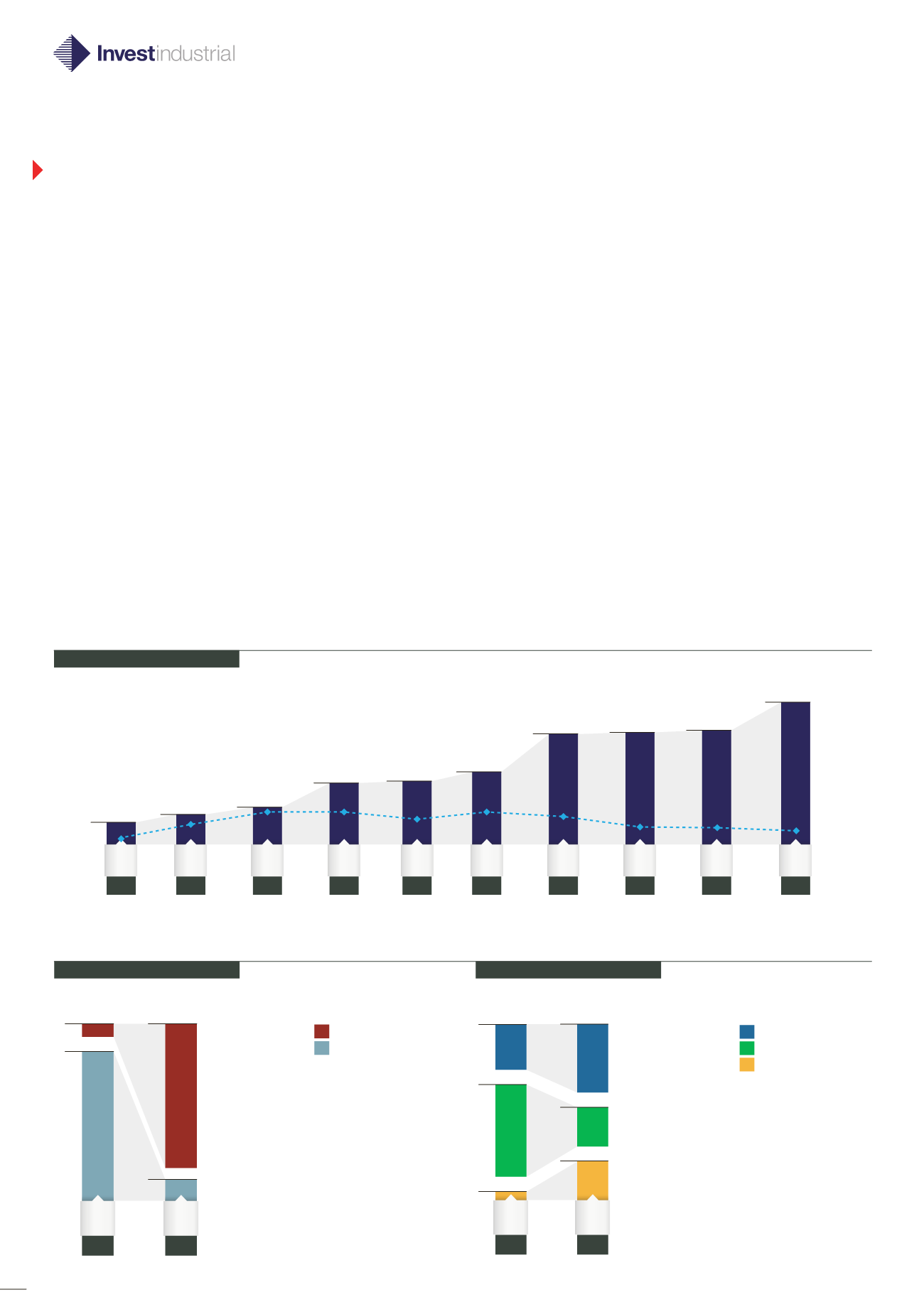

2013

2012

2011

2010

79.0

2009

90.6

137.5

142.1

2008

2007

2006

25.4

2005

34.7

43.0

71.3

143.0

26,1%

27,1%

27,1%

25,8%

20,4%

26,6%

26,4%

25,3%

25,2%

2014PF

21.9%

175.0

Under Investindustrial’s ownership Avincis underwent a

major transformation: nine add-on acquisitions have been

completed allowing the company to strengthen its presence

in Italy, France, the UK, Portugal, Chile, Peru, Ireland, Norway,

Australia, Denmark, Finland and Sweden. In the first quarter

of 2014 Avincis continued its internationalization strategy by

reaching an agreement for the acquisition of Scandinavian

AirAmbulance, the leading provider of air ambulance services in

the Nordic region. During 2013 Avincis continued the integration

of Bond Aviation Group acquired in 2012, a major independent

UK helicopter operator, which provides offshore (Oil & Gas)

transportation and mission critical emergency helicopter

services under long-term contracts. This acquisition allowed

Avincis to enter the heavy fleet segment, in which the company

was not present, providing access to further future growth.

In addition, Avincis increased its presence in the strategically

attractive segment of the Oil & Gas helicopter services market

that strongly resembles Avincis’ core business lines, given the

mission-critical nature of helicopter transportation in the North

Sea, the high component of search & rescue operations, and

the structure of Bond’s contracts with major Oil & Gas blue-chip

operators (long-term, fixed charged revenues). Avincis continues

to be well positioned for future growth, both organically and

through additional bolt-on acquisitions. In early 2014, Avincis

was sold to Babcock International, the UK engineering support

service leader, after the two companies initially started

collaborating on bidding for new contracts. The sale of Avincis

was completed valuing the company at

€

2 billion.

Achieving

internationalisation

and business diversification

while strengthening profitability

EBITDA (

€

m) and Margin (%)

By Year

Sales (%)

By Country

By Category