20

The broad network of Industrial Advisors has specific industrial

expertise in their sectors, a history of strong relationships with

Investindustrial, and is headed by the Industrial Advisory Board.

The Industrial Advisory Board provides industry expertise, views,

opinions and strategic advice on industrial and business plans to

the Boards of the Investment Managers and Holding Companies.

Its members act as consultants and do not have any fiduciary

obligations. They are an integral part of Investindustrial’s business

model and industrial approach, providing competence from

operational and strategic issues in their fields of expertise.

The members of the Industrial Advisory Board are seasoned

executives who bring valuable industrial expertise in a wide range

of sectors and are closely linked to the Group’s industrially-driven

operational model. The Industrial Advisory Board is chaired by

Andrea C. Bonomi.

The Industrial Advisory Board

An

organisation

tailor-made

for active ownership throughout

the investment process

Investindustrial leverages proprietary networks to source

attractive investment opportunities typically unavailable to the

broader market. Since inception the vast majority of portfolio

investments have been sourced through proprietary channels,

including family and corporate vendors, Public-to-Privates and

public situations, a deliberate course of action which has yielded

attractive entry multiples.

Investindustrial allocates resources to a concentrated group

of investee companies but actively seeks to mitigate risks, and

control returns, by holding a portfolio of assets that exhibits

natural diversity. Target companies are typically in growth or

mature phases of their lifecycle with the level of support required

categorised in the following ways: consolidate position as local

leader, strategic repositioning, international expansion, accelerate

growth through acquisition and/or new products and markets.

Investindustrial provides hands-on support to investee companies

through the team’s breadth and depth of expertise. The ability

to deliver on often complex operational and organisational

plans is underpinned by the broad and deep internal sector

expertise developed across many business cycles and is actively

supported by the internal Business Development Group. The

team’s experience combines strong local investment insight with

a global perspective which is leveraged to ensure the successful

execution of the industrially-driven approach. As active investors

Investindustrial works closely with key management throughout

the ownership phase to drive product growth and/or market

expansion. This includes actively securing industrial, branding and

To help its portfolio companies achieve their full potential, and in

support of the active ownership approach, Investindustrial can

count on the valuable commitment of its Industrial Advisors. These

seasoned executives bring industrial expertise in a wide range of

sectors and are closely linked to the group’s industrially-driven

operational model.

The Industrial Advisors concentrate their advice on maintaining

best practice corporate governance, stress testing industrial plans

and identifying global value creation opportunities.

A unique network of Industrial Advisors

financial partners from inside, or selectively from outside, our

network. These proprietary relationships have been developed

over many cycles and are inherently interlinked, making it difficult

for competitors to replicate them, which further entrenches

Investindustrial’s status as the preferred partner for high-quality

mid-market businesses in Southern Europe and opportunistically

in Western Europe.

The industrially driven, responsible and active ownership

approach of Investindustrial creates a natural allegiance

with corporate players who are looking to acquire high

quality strategic assets. As part of the value creation process

Investindustrial identifies potential trade buyers with which there

may be valuable synergies and actively engages in dialogue

throughout the holding period. Industrial and strategic buyers

have accounted for the majority of Investindustrial exits to date,

which habitually leads to an attractive increase in the realised

value when compared to the most recent valuation prior to exit.

20

14

Who We Are

//

ANNUAL REVIEW & SUSTAINABILITY REPORT

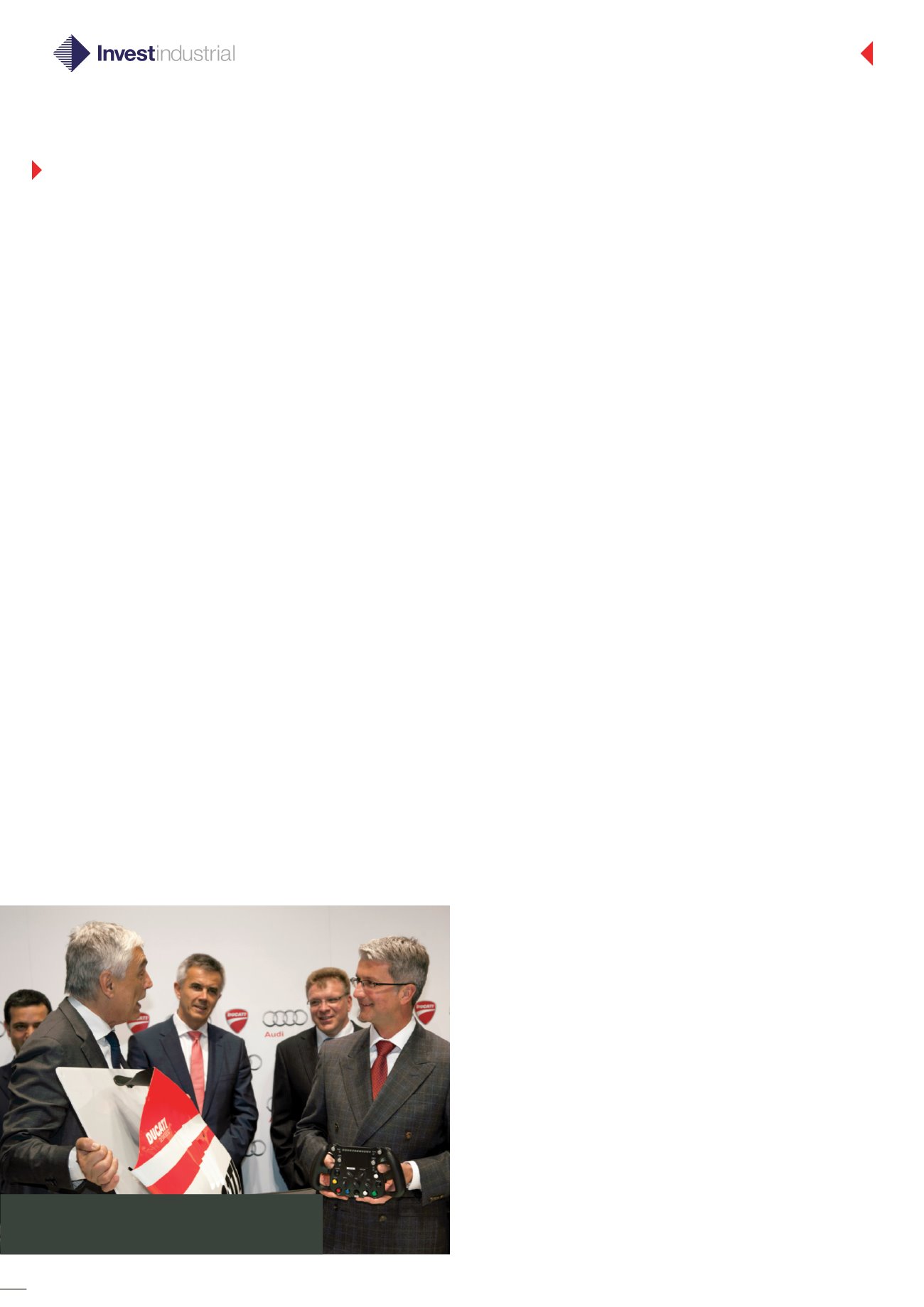

Gabriele Del Torchio (Member of the

Investindustrial Advisory Board and former CEO

of Ducati) and Rupert Stadler (CEO of Audi)