Climate and Carbon Neutrality

Our Proprietary Approach to Climate Change

Climate change will result in changes to weather, consumer demands, societal expectations, and the economic viability of certain assets and business models, as well as the development of new regulation and technology. To build resilience to climate change, create value, and prepare for a low-carbon future, Investindustrial’s Sustainability team works with its portfolio companies to understand the potential impacts of climate change on their entire value chain.

The Sustainability team provides support to reduce or prevent the emission of greenhouse gases, in line with Investindustrial's climate mitigation strategy detailed below. Responsibility for implementing climate initiatives lies solely with the portfolio company Board and management teams.

Real Economy Climate Action

Since 2019, at the pre-investment due diligence stage, a formalised and systemic analysis of climate-related risks and opportunities is undertaken. In the context of the Taskforce on Climate-related Financial Disclosures (TCFD) framework, to which Investindustrial became a signatory in 2020, these risks and opportunities pertain to transition risks of a decarbonising economy, and physical risks and opportunities.

These risks and opportunities are then assessed for their materiality over the medium-term (10-15 years). Any material findings and mitigating actions are included in the advisory teams’ value creation plans as well as the portfolio company’s 100-day plan where the issues are prioritised, and budget allocated in the context of the other business needs and overall strategy.

Short-Term Climate Change Commitments

In November 2021, along with five other private equity firms, Investindustrial set validated science- based targets (SBTs) aligned with 1.5°C. At the same time, Investindustrial became one of only a few private equity signatories of the Net Zero Asset Manager Initiative (NZAM). As a signatory of NZAM, Investindustrial commits to work in partnership on decarbonisation goals, consistent with an ambition to reach net zero emissions by 2050 or sooner across all assets under management (AUM). Investindustrial’s short-term SBTs and NZAM climate commitments cover both Investindustrial and its portfolio. The Firm's validated targets are as follows:

- Investindustrial

- Investindustrial commits to reduce scope 1 and 2 GHG emissions by 68% per headcount by 2030 from a 2019 base year.

- Investindustrial commits to increase annual sourcing of renewable electricity from 45% in 2019 to 100% by 2030.

- Portfolio

- Investindustrial commits that 50% of its Private Equity investments by invested capital will have set science-based targets by 2026 and 100% by 2030.

Climate Change Approach

In alignment with commitments to SBTi and NZAM, Investindustrial’s comprehensive carbon and climate change mitigation strategy considers both technological and nature-based solutions and follows a three-pronged approach covering both Investindustrial and its portfolio:

1. Reducing carbon emissions at source

Since 2016, all portfolio companies have embarked on energy efficiency, renewable energy and value chain decarbonisation projects to both reduce operating costs as well as their carbon footprints. Portfolio companies have started work to set SBTs in line with a global commitment to curb greenhouse gas emissions sufficiently to limit global warming to 2°C or below by 2050. At the end of 2022, eight portfolio companies had committed to SBTs, of which three have had their SBTs validated by the SBTi, and one has submitted their SBTs for validation. A further eight portfolio companies were evaluating the feasibility of an SBT commitment.

2. Sourcing renewable and low carbon energy solutions

Portfolio companies are encouraged to source low carbon and renewable energy sources via either on-site (e.g. photovoltaic panels) or off-site solutions (e.g. power purchase agreements or green energy supply contracts). A revised target to align to Investindustrial's SBT commitment has been set as part of the 2030 Sustainability Strategy for 100% of electricity consumption to be sourced from renewable energy across the portfolio by 2030.

3. Offsetting remaining carbon emissions via nature-based climate solutions

Understanding climate change impact, both pre and post-investment, has been the cornerstone to how Investindustrial manages its approach to climate change. Inherent in this understanding is also the fact that not all carbon emissions can be avoided or reduced at this stage in the decarbonising cycle for a portfolio as diverse as that at Investindustrial. As such, offsetting emissions that remain has always been a known actor and one for which Investindustrial has taken an equally strategic approach. Since 2009, Investindustrial has been working towards sourcing quality proprietary nature-based solutions working directly with project developers in their local markets.

Investindustrial has been carbon neutral as an organisation for the last 14 years, and its share as an investor in the portfolio companies for the past six years. In 2020, Investindustrial became carbon neutral across all investments in active funds.

Our Journey to Net Zero: Residual Emissions Reduction

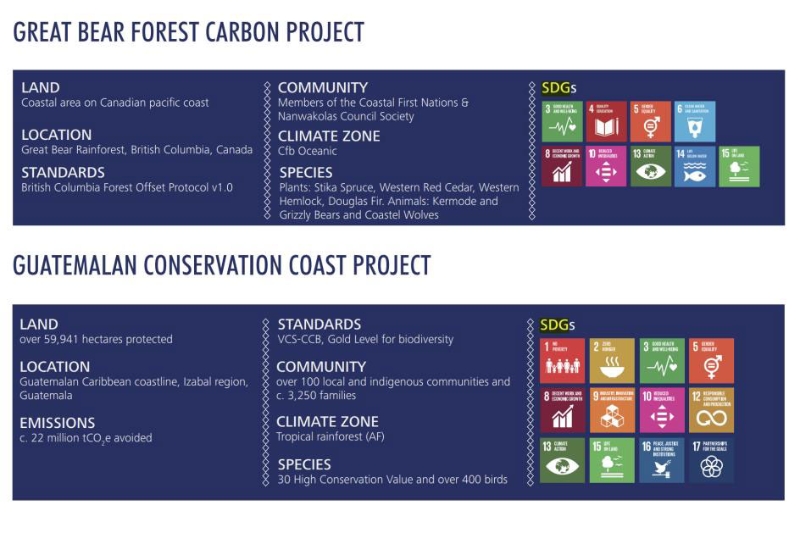

Investindustrial believes that by investing in solutions that provide direct access to global carbon projects, it has more control over quality projects, which helps to improve value, whilst reducing risk and generating tangible social, climatic and biodiversity outcomes. Current nature-based climate solutions that Investindustrial has invested in are the Blue Carbon Project, the Great Bear Forest Carbon, and the Guatemalan Conservation Coast Project.