4

“Investindustrial has proven across several

cycles that macroeconomic headwinds can

largely be mitigated through the disciplined,

industrially driven and active ownership model”.

“Investindustrial continues to invest significant

capital and intellectual resources into quality

companies“.

“Throughout 2014 Investindustrial made

additional improvements across its business

platforms and investment portfolio to further

entrench its position as a leading European

private mid-market investor”.

The leadership position Investindustrial has established by

focusing on Southern Europe, and opportunistically across

Western Europe, has been achieved through perseverance

across cycles to act as a transformational owner for a select

group of quality companies.

By the end of 2014, Investindustrial expanded its latest

investment programme with the acquisitions of Flos, the leading

Italian high-end lighting brand, and Goldcar, the leading value

leisure car rental company in the Mediterranean region.

During the year Investindustrial also continued to dedicate

resources to Aston Martin that increased its capital to continue

the biggest R&D project in its 102-year history, which is expected

to have a transformational impact on the company’s long-term

performance and sustainability. Additionally, the partnership

with Daimler on new engines and electric and electronic

components is underway and the automotive community

eagerly anticipates the launch of the DB10 as James Bond’s new

car in the Spectre movie to be released in November 2015.

In 2014, recovering financial and macroeconomic conditions

provided the opportunity for Investindustrial to seize attractive

divestment opportunities that arose as a result of the careful

preparation, management and positioning of investee

companies for sustainable long-term growth. Starting with the

partial sale of PortAventura in December 2013, Investindustrial

managed exits from four portfolio companies, and a further exit

20

14

Strategic Commentary

//

ANNUAL REVIEW & SUSTAINABILITY REPORT

STRATEGIC

COMMENTARY

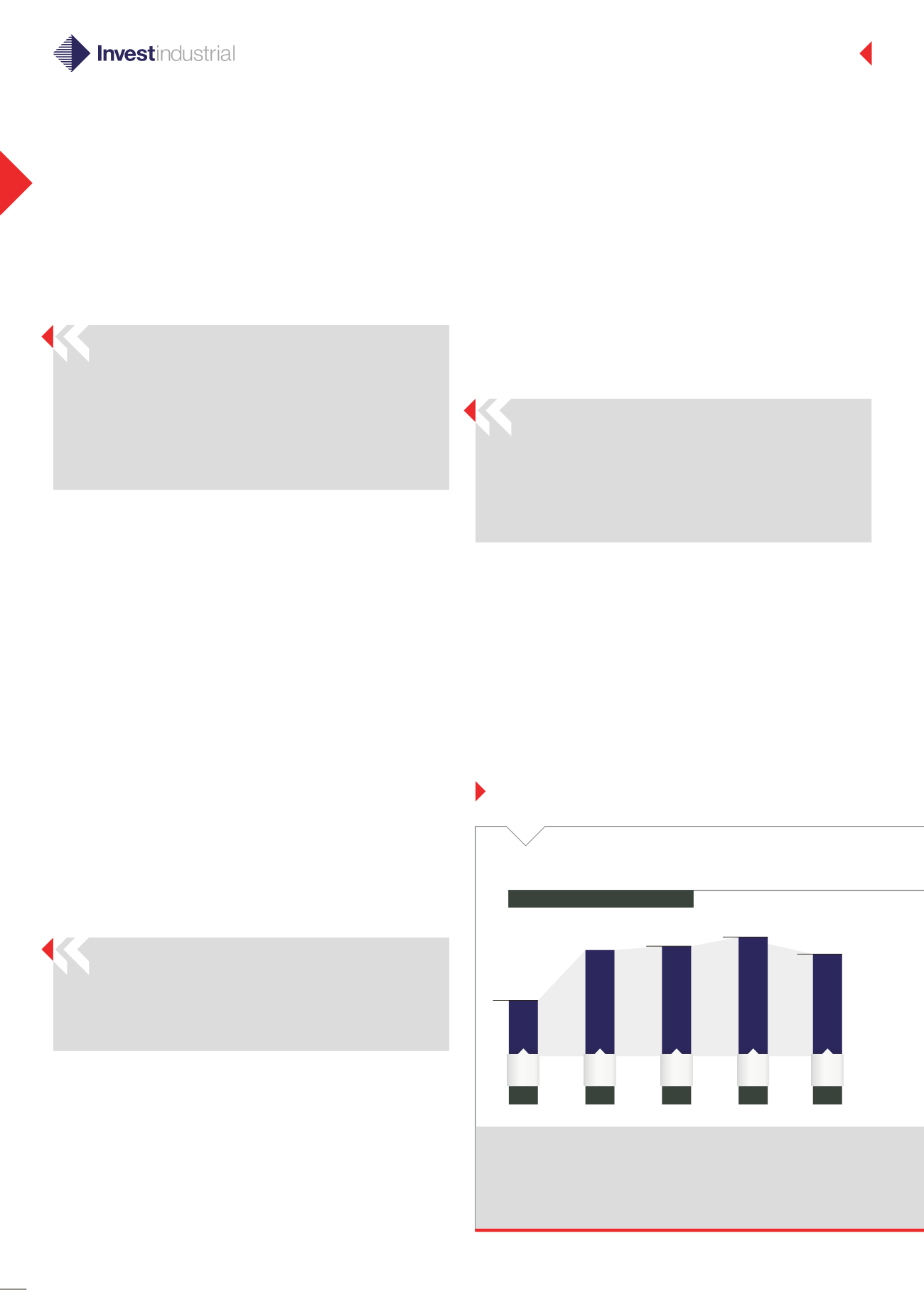

2013

2012

2011

2010

4,835

7,426

7,677

8,392

2014

7,221

Sales (

€

m)

By Year

Total investments generated aggregate sales of

€

7.2 billion in

2014 with a decrease of

14%

compared to the prior year, as a

result of the full sale of three portfolio companies; excluding these

transactions the sales grew by

12%

+54%

+3%

+9%

-14%

2014

Portfolio

figures

in 2015, generating distributions of more than

€

1.1 billion for its

investors.

A key contributor to Investindustrial’s long term success,

and one which has now become a significant competitive

advantage, is the ability to form strategic external partnerships.

Throughout 2014, Investindustrial continued to develop and

nurture these industrial, brand, and capital partnerships.