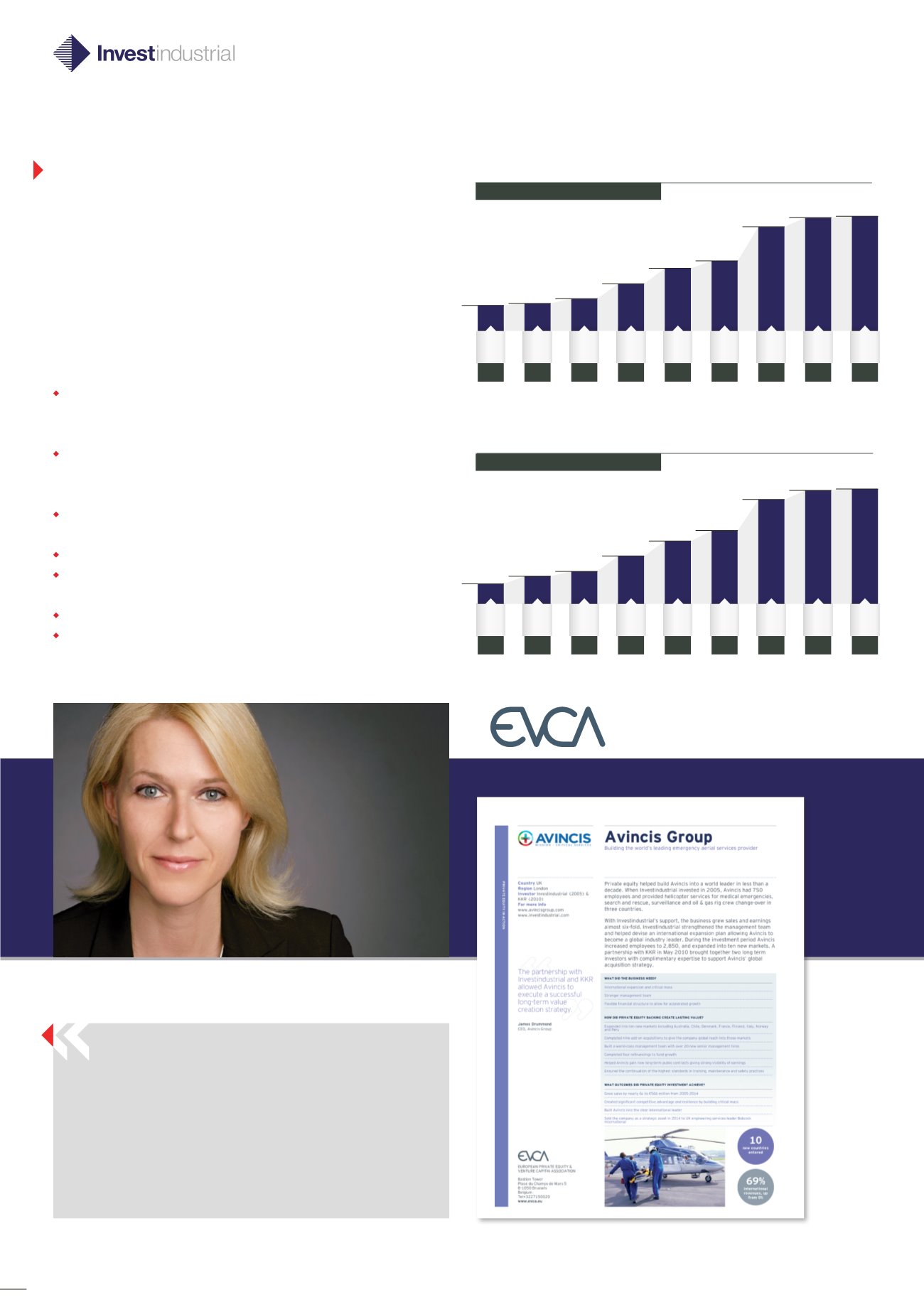

54

124.6

2005

134.8

2006

158.8

2007

262.9

2008

302.3

2009

340.8

2010

2011

521.4

2012

562.4

2013

566.5

25.4

2005

34.7

2006

43.0

2007

71.3

2008

79.0

2009

90.6

2010

2011

137.5

2012

142.1

2013

143.0

+8% +18% +66% +15% +13% +53% +8% +1%

Avincis EBITDA (

€

m)

By Year

Avincis Sales (%)

By Year

Following the successful sale of Avincis, the European venture

Capital Association (EVCA), approached Investindustrial

to showcase the investment as an example of sustainable

investing. Highlights of the Investindustrial investment thesis

and actions include:

Development of a company with a solid and sustainable

business model, high quality services and strong attention

to safety.

Significant expansion in new markets such as Australia,

Chile, Denmark, France, Finland, Ireland, Norway, Peru,

the UK and Sweden.

Strengthening of management team and corporate

governance.

Avincis was sold to a solid and reputable industrial partner.

Strengthening of the financial structure through four

refinancings to fund growth.

Significant increase in the workforce.

Investindustrial promoted Avincis to adhere to the

UN Global Compact initiative and to report on progress.

Promoting acceptance and

implementation of

responsible

investing

within the industry

+37% +24% +66% +11% +15% +52% +3% +1%

D

ö

rte H

ö

ppner

,

Secretary-General

European Venture Capital Association

“Avincis is an excellent example of how

Investindustrial has been able to help build

a private, European mid-market company into

a world leader. Private equity in Europe plays

an increasingly important role in creating jobs

and raising companies’ global competitiveness”.